Most millennials are not taught how to manage money effectively. Many people find the student loan crisis a difficult problem. It is essential that millennials have a financial plan. This plan should evaluate your current goals and help you prepare for long-term financial goals. It should address all financial issues, including debt repayment, saving money for retirement, and a downpayment on a house.

Alvin Carlos

Alvin Carlos, an independent financial planner, assists millennials in achieving the financial security they seek. He has been a certified financial planning professional since 2011. He has helped clients throughout the country reduce taxes and maximize their money. These are just a few of the many benefits you get from having a financial professional on your side.

Young professionals are typically in the early stages of their careers and don't have much to offer. They are often juggling several priorities, including paying off student loans, saving for a home, and growing a career. It can be difficult to find the time to plan for all these goals. You can have your financial goals met while still managing your other responsibilities with the right financial planner.

Sophia

Sophia is a financial planner for millennials and a woman who has matched her money with her values. She's worked with Silicon Valley employees, small business owners, and creatives to make plans for their early retirement and build a fulfilling career. Sophia, who was 21 years old, started her own financial consulting firm. Sophia started her own financial planning firm after working as a personal advisor to friends. She helped them find a job, analyze company benefits and buy a home. She wanted her education to assist others in achieving their goals.

Sophia's goal is to empower millennials by helping them make sound financial decisions. She works with large banks to help them understand their financial needs and teaches others how to become financial planners. Sophia's work has been featured on Forbes, Business Insider, and The Huffington Post.

Neal

Many millennials find it difficult to find a financial advisor that can help them navigate through the financial complexities. But with the help and guidance of the right financial adviser, it's possible to achieve financial independence. Neal McLaughlin, a Chartered Financial Planner and member of the millennial age, is an example of such an advisor. This individual is committed to helping young professionals, as well as their families, navigate today's complex financial world.

Financial planners can help young people achieve their financial goals. The policies they create will ensure clients can meet their current and future needs without compromising the ability to meet their monthly obligations. One policy like this would direct five percent each month of a client’s surplus to a Roth IRA. This amount can be up to the maximum allowed per year. The surplus can be used for travel or other purposes.

FAQ

What Is A Financial Planner, And How Do They Help With Wealth Management?

A financial planner is someone who can help you create a financial plan. A financial planner can assess your financial situation and recommend ways to improve it.

Financial planners can help you make a sound financial plan. They can help you determine how much to save each month and which investments will yield the best returns.

A fee is usually charged for financial planners based on the advice they give. Some planners provide free services for clients who meet certain criteria.

What is wealth management?

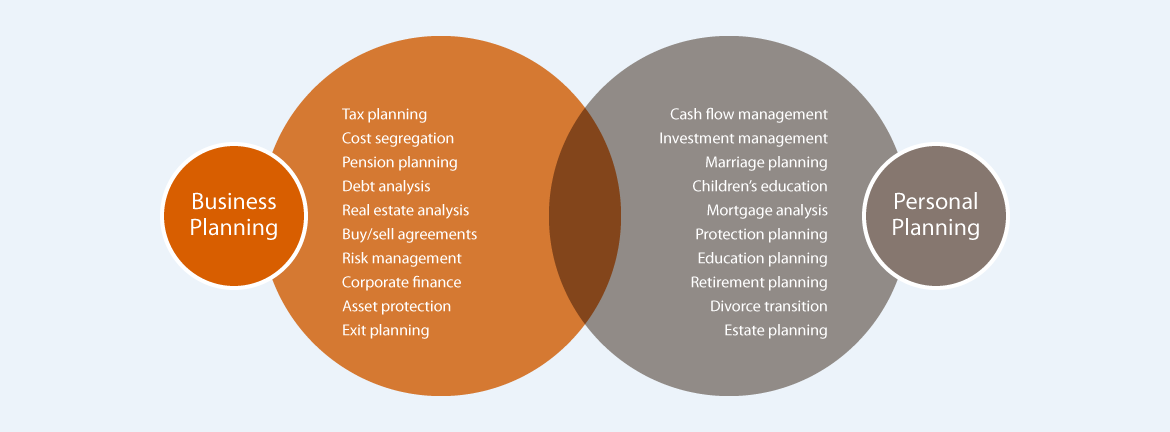

Wealth Management can be described as the management of money for individuals or families. It includes all aspects of financial planning, including investing, insurance, tax, estate planning, retirement planning and protection, liquidity, and risk management.

How to Choose an Investment Advisor

Selecting an investment advisor can be likened to choosing a financial adviser. There are two main factors you need to think about: experience and fees.

The advisor's experience is the amount of time they have been in the industry.

Fees refer to the costs of the service. It is important to compare the costs with the potential return.

It is essential to find an advisor who will listen and tailor a package for your unique situation.

How can I get started in Wealth Management?

First, you must decide what kind of Wealth Management service you want. There are many Wealth Management services, but most people fall within one of these three categories.

-

Investment Advisory Services- These professionals will help determine how much money and where to invest it. They offer advice on portfolio construction and asset allocation.

-

Financial Planning Services – This professional will help you create a financial plan that takes into account your personal goals, objectives, as well as your personal situation. Based on their expertise and experience, they may recommend investments.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

What is risk management and investment management?

Risk management refers to the process of managing risk by evaluating possible losses and taking the appropriate steps to reduce those losses. It involves the identification, measurement, monitoring, and control of risks.

Any investment strategy must incorporate risk management. The goal of risk management is to minimize the chance of loss and maximize investment return.

These are the key components of risk management

-

Identifying the risk factors

-

Measuring and monitoring the risk

-

Controlling the risk

-

How to manage risk

What age should I begin wealth management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The sooner you begin investing, the more money you'll make over the course of your life.

You may also want to consider starting early if you plan to have children.

You could find yourself living off savings for your whole life if it is too late in life.

Statistics

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How to save cash on your salary

You must work hard to save money and not lose your salary. These are the steps you should follow if you want to reduce your salary.

-

Start working earlier.

-

You should cut back on unnecessary costs.

-

Online shopping sites such as Amazon and Flipkart are a good option.

-

Do your homework at night.

-

Take care of yourself.

-

Try to increase your income.

-

Live a frugal existence.

-

You should learn new things.

-

Sharing your knowledge is a good idea.

-

You should read books regularly.

-

Make friends with rich people.

-

It's important to save money every month.

-

Save money for rainy day expenses

-

It is important to plan for the future.

-

Time is not something to be wasted.

-

You must think positively.

-

Negative thoughts are best avoided.

-

Prioritize God and Religion.

-

It is important that you have positive relationships with others.

-

You should have fun with your hobbies.

-

It is important to be self-reliant.

-

Spend less than you make.

-

You should keep yourself busy.

-

You should be patient.

-

Always remember that eventually everything will end. It is better not to panic.

-

Never borrow money from banks.

-

You should always try to solve problems before they arise.

-

You should try to get more education.

-

It is important to manage your finances well.

-

It is important to be open with others.