A financial consultant provides financial advice for clients. They have to undergo certain training and must be registered with a regulator. You can become a financial advisor in a number of ways. Consider a CFP designation or ChFC designation if you are interested. There are also several different types of business structures available.

A CFP alternative is the designation of Chartered Financial Consultant (ChFC).

The Chartered financial consultant (ChFC), a more specialized designation for financial planners, is available to those who want to become one. Candidates must have completed eight financial planning courses and have had three years experience. These courses can be used to help with personal finances, retirement planning, investments and insurance. The CFP exam is proctored. It has a pass rate between sixty-five percent and seventy percent.

A ChFC designation can be used by financial professionals like insurance agents and stockbrokers, real-estate agents, loan officers and bankers as well. It can also boost the credibility for tax and accounting professionals.

Different business structure options for financial advisers

It is crucial to choose the right legal entity when starting a business. Different business structures can have their advantages and disadvantages. For example, some are less taxed than others, and others make the owners personally liable for failures. Some structures are less protected from lawsuits. A financial consultant can help determine the best structure for your company.

A financial consultant could be either a sole proprietorship of a company or a division of a larger organization. A sole proprietor can only have one owner. A married couple can have multiple owners. An LLC can have up to 100 shareholders or members. Each entity must have its own governing documents, as well as state rules in order to be able to operate.

To maximize your profitability and minimize risk, it is important to choose the right legal entity. When choosing a legal entity, the main considerations are ease of formation, taxation, liability. A sole proprietorship is the easiest to set up and maintain but you are also open to personal liability. A LLC or S Corporation structure may be better suited for larger consulting companies. Each offer similar protections to a sole proprietorship but the S Corporation structure gives more responsibility to its shareholders.

Financial consultants receive compensation

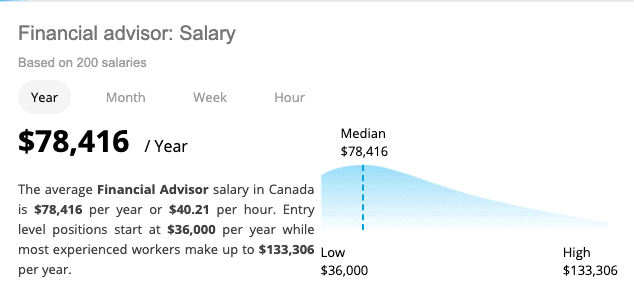

Financial consultants are compensated based on what product or service they offer. Based on their past performance and experience, some financial consultants earn a higher salary than others. In most cases, the financial consultant will earn between six and eight percent of the average balance on their clients' accounts. They may also receive higher compensation if they are working on credit products.

ZipRecruiter's analysis reveals that Chicago is a competitive market for financial professionals. The average salary for a Financial Consultant in this area is $87.808, which is about $2,188 less than the national median. ZipRecruiter ranks Illinois among the 50 states that offer Financial Consultant salaries.

FAQ

What is estate planning?

Estate Planning is the process that prepares for your death by creating an estate planning which includes documents such trusts, powers, wills, health care directives and more. These documents are necessary to protect your assets and ensure you can continue to manage them after you die.

What are the best ways to build wealth?

It's important to create an environment where everyone can succeed. You don’t want to have the responsibility of going out and finding the money. You'll be spending your time looking for ways of making money and not creating wealth if you're not careful.

It is also important to avoid going into debt. It is tempting to borrow, but you must repay your debts as soon as possible.

You set yourself up for failure by not having enough money to cover your living costs. When you fail, you'll have nothing left over for retirement.

Before you begin saving money, ensure that you have enough money to support your family.

How does Wealth Management work

Wealth Management is a process where you work with a professional who helps you set goals, allocate resources, and monitor progress towards achieving them.

Wealth managers assist you in achieving your goals. They also help you plan for your future, so you don’t get caught up by unplanned events.

They can also prevent costly mistakes.

How to Beat Inflation by Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution people have had to start saving money, it has been a problem. The government attempts to control inflation by increasing interest rates (inflation) and printing new currency. However, there are ways to beat inflation without having to save your money.

For example, you could invest in foreign countries where inflation isn’t as high. You can also invest in precious metals. Since their prices rise even when the dollar falls, silver and gold are "real" investments. Investors who are concerned by inflation should also consider precious metals.

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

How to invest once you're retired

When people retire, they have enough money to live comfortably without working. But how do they put it to work? There are many options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You could also choose to take out life assurance and leave it to children or grandchildren.

If you want your retirement fund to last longer, you might consider investing in real estate. Property prices tend to rise over time, so if you buy a home now, you might get a good return on your investment at some point in the future. You might also consider buying gold coins if you are concerned about inflation. They don’t lose value as other assets, so they are less likely fall in value when there is economic uncertainty.